The property damage that occurs during a typical automobile accident is typically covered either by the individual's own policy, specifically under their collision coverage, or is paid for by another driver's coverage if they are at fault. Sometimes, it becomes crucial to choose between these two options, as one's own insurance company may provide better treatment and compensation compared to the other driver's company. Additionally, if the issue remains unresolved or becomes a significant financial burden, the individual's company may seek reimbursement or become directly involved to ensure fair payment.

Award-winning PDF software

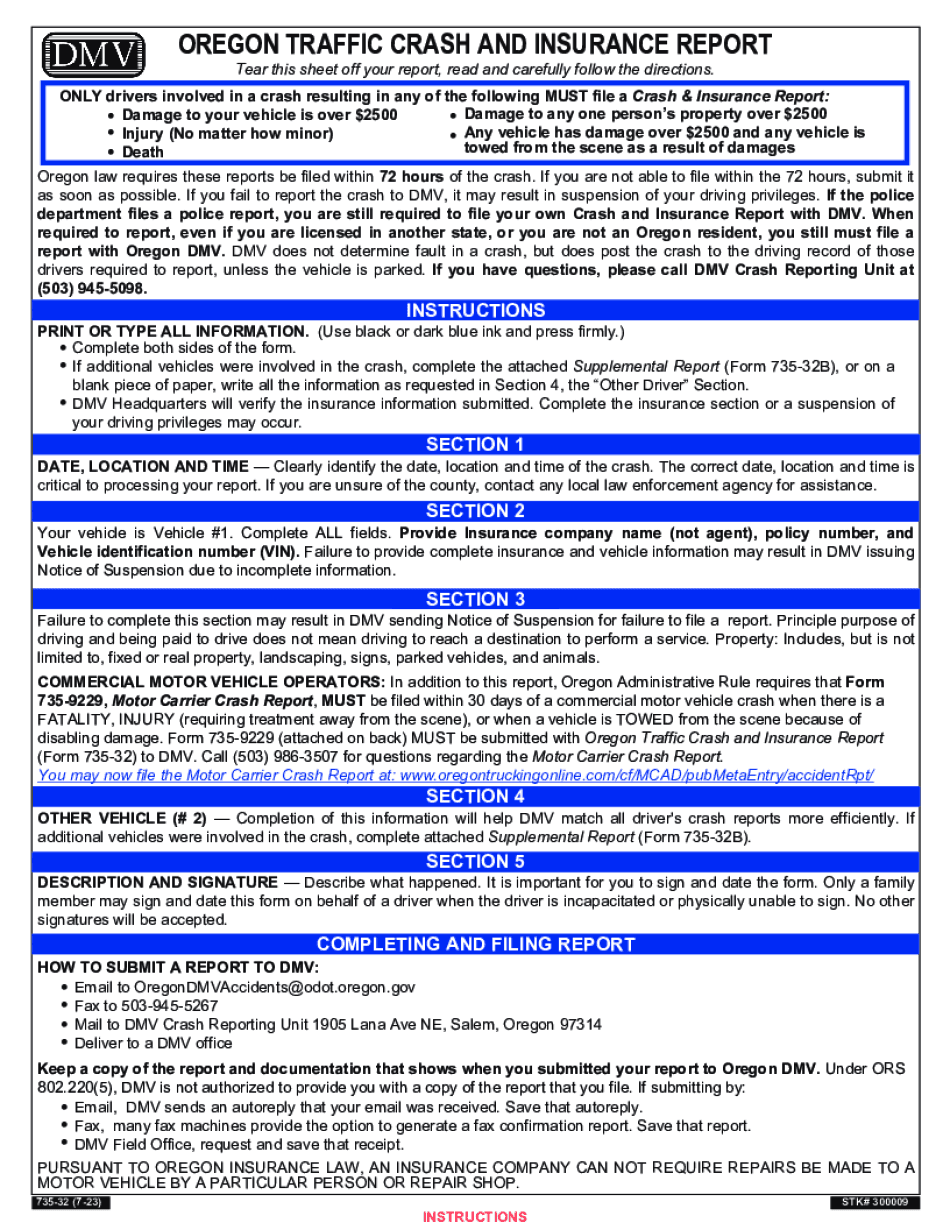

Oregon auto accident laws Form: What You Should Know

DMV report. You also have to file a DMV form report about the collision within 72 hours if the injured person died as a result of the collision. 19. DMV report. You need to file a DMV form report within one year of the date of a certified accident report. 20. DMV report. You have to file the DMV report within four weeks of filing a verified form for the insurance underwriter if damage was over 500. 21. DMV form. You also have to file a vehicle insurance claim report with DMV within three days of the accident. If an accident occurred at night, DMV doesn't need to report until five days after the accident. 22. DMV report. If a police officer has not filed the report and has not filed a DMV form for the insurance underwriter by the time the insurance company files it, then the insurance company might not charge you for damages on the insurance claim. In that event, keep the original insurance report. 23. DMV report. Once a car is repaired the insurance company must report damages within 10 days of the repair. 24. DMV form. In all cases, the insurance company must report the following to DMV to determine whether the damage was caused by a motor vehicle or by an object other than a motor vehicle or was caused by a defect or condition that is the subject of an item in the report. All reported damages, whether the damages result from the collision of a motor vehicle or from the collision of another object. (Solo) 25. Report within 45 days before the end of the automobile insurance company's policy term period by filing the report on any day. (Solo) You can also file a new car insurance claim form (with the insurance company, if you wish) within 72 hours of the date of the car accident. (Solo) This form must be filed within four weeks after you contact the insurance company directly to make the claim. 26. You must obtain a copy of the insurance company's collision report or a copy of the report submitted by the other party after the insurance company is notified that the report will be filed. (Solo) 27. You must take the same position in the insurance claim the insurance company took in a collision on the property of the other party. (Solo) 28.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do OR 735-32, steer clear of blunders along with furnish it in a timely manner:

How to complete any OR 735-32 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your OR 735-32 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your OR 735-32 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Oregon auto accident laws